Have recently sold off the following stocks :

Bajaj Finserve at 2960 level

LIC HF at 590 levels

Liquidated 75% of my holdings in VST at 2420

Royale manor at 11.5

Have recently sold off the following stocks :

Bajaj Finserve at 2960 level

LIC HF at 590 levels

Liquidated 75% of my holdings in VST at 2420

Royale manor at 11.5

It has been quite some time since i have posted anything on the blog and that is because of one main reason : I have posted quite a lot of stock recommendations in the past but because of lack of significant amount of capital i was unable to build my own portflio properly and hence what would seem ironical- i myself could not benefit the most from my analysis- was happening. However when the market went down this time once again between Jan ’16 – April ’16 , i wanted to focus on the allocation of my spare time from my job to invest in high conviction scrips and see if i get the desired results .

So i kept busy with my personal finances – however it was possible to post my views on facebook with a single sentence or two , and so ,i had the opporunity to keep on doing that from time to time.

Fortunately, the results have been great. The portfolio of picks managed to give a return of around 42% returns in this period of 6 months .

Major winners were :

City Union bank – from 88 to 131 – Holding, recommended on the blog several times

Manappuram Fin- From 31 to 83 – Holding, recommended on the blog several times

Bajaj Finserve – 1680 to 2820- HoldingGulf Oil – 530 to 690 – Sold off, would re-enter

Yes Bank : Holding since 330 rs, CMP 1330 Rs,recommended on the blog several times

VST industries : from 1680 to 2290 – Holding

Patels Airtemp : from 130 to 156 – holding

CARE Rating : from 970 to 1250, AVG cost of 1180 Rs- holding, recommended on the blog

Greenply Industries – 154 to 210 – Sold off, CMP 260

Shivalik Rasayan – 88 to 127 – Sold off, CMP 155

ITC : from 305 to 350 ( Undajusted ) – Sold off

LIC HF : Holding since 215 Rs, CMP 577,recommended on the blog several times

DB corp : from 310 to 380 , Sold offf. CMP 410

Major Underperformers/ Losers are :

Persistent System : from 620 to 630

Intellect Design – From 214 to 187

Royale Manor – from 11.5 to 11.05, recommended on the blog

Aban : 310 to 216 , sold off.

Overall it has been a rewarding exercise , and due to which i have been unable to post new views/ analysis. I intend to devote more time towards portfolio management and till the time the market is in a limbo i need to keep doing more homework in order to uncover new gems, or just come back to old ones. I will be updating my fb page from time to time. Readers are welcome to connect to me on mail id sci.aditya1@gmail.com.

Expect to resume posts after Oct- 2016

Cheers

Gareeb Equity Analyst

In the last 2 months markets have rebounded from their lows and bulls are back with more confidence. Many small caps have rebounded and many largecaps are encountering heavy buying interest. After every night there is a morning and some of the scrips are basking in this morning sunshine.

Today Idea cellular has touched a 3 month high of 121.5 Rs. The stock was quoted as a value buy at 101 Rs around 2 months ago. This implies a 20% absolute return. If this position is liquidated and the returns are invested in a 10 month FD currently quoting at 7% with some leading banks, you would have netted a return of 25% annual return. That is almost like matching Buffet’s rate of return.

Those of you who are risk averse , the wiser way would be to be satisfied with 25% returns and book your profits. Having said that nothing has changed on the fundamentals of the company or the telecom system and all uncertainties as well as positives remain.

Following Lynch has helped a lot of retail investors and i could not be more thankful for having discovered his teachings.

UPDATES : Other scrips mentioned on this blog recently are not doing so well and it is a mixed bag here but i still belive in Lynch’s philosphy and the ability to apply it in indian markets. As always it is up to you , the investor to make a choice.

CARE rating : Mentioned at 1500 Rs , and currently quoting close to 1100. Scrip went down to 880 Rs as well and as a favorite averaging strategy mentioned on this blog is to average at every 10% dips the average weighted price would be close to 1220 Rs. That implies the current price is 10% below the recommended price. This is obviously not a profitable position currently but this is a long term bet, and we would keep reviewing the business from time to time.

Royale manor : Being a microcap stock it has see-sawed up and down. Currently quoting at 12.1 Rs, which is close to the entry price. So no profit no loss here , but I would wait for quarterly results and annual report before taking a call on this scrip

All other perennial buys like Yes bank, LIC housing finance etc are doing well and given a steady rate of return over the last 6 months. Can be added at all dips till the business deteriorates.

Cheers

Gareeb Equity Analyst

Sometimes it so happens that the price of a stock remains at the same level where you left it a long time ago. Nothing wrong with that , unless the business also remains stagnant.

More than 4 years ago i gave a buy call on Idea cellular around 83 Rs, and asked to quit at 98-99 Rs. Today the stock price is again at 101 , which is almost within an inch of the exit price. So what has changed in all these years.

| Parameter | 2011 | 2016 E |

| Annual revenue | 19400 | 35000 |

| EBITDA | 3100 | 11200 |

| PAT | 844 | 2900 |

| M Cap | 35000 | 36500 |

| PE | 41 | 13 |

| Consolidated debt | 10500 | 26000 |

So we can see that business has boomed – Revenues has increased from 19000 crores to 35000 crores, while profit has increased from 844 crs to 2900 crs.

And yet the mcap of the company has remained almost the same . Why??

2-3 reasons can be attributed to this

However if we look at global markets and mature ones , we can take a cue that 4G is more or less the technolgical plateau for quite some time and the road from here is not uphill but rather flat ahead. So once the pain subsides the return on investments will not only increase but explode because of the assets being depreciated out. I am not so sure on the license cost because the government has given license for 13 years and it might again tell the TELCOs to bid for the spectrum renewal.

Idea cellular has a strong parentage and a very good track record of execution. Also, the management is wise enough to not burn cash in useless adventures and acquistions, so i believe the management and execution risks are taken care of.

India is a growing economy and the rural and poor urban segment has only recently started using smartphones. As data costs become more cheaper, data consumption growth will continue at a steady rate.

At the current price of 101 Rs all the above negatives seem to be priced in and it could be a profitable bet for people who are willing to take a risk. As always the choice is yours. 🙂

Cheers

Gareeb Equity Analyst

It is that time of the year when all of a sudden market experts have started talking about gloom and doom and how banks are bad, rupee will crash, India is no more attractive and China panic is going to eat away India’s lunch and so on. 6 months ago , many of these people were busy promoting the India story.

Looks like all the market pundits are having a reluctant change of heart. But my point is that if you are telling me that it is a train crash when the train crash is already happening then you are not a pundit.

You are just a news reporter!!

No better than Udayan Mukherjee.

So I’m sorry , but i will prefer to listen to Udayan Mukherjee who at least does not pretend that he is an expert.

Please ignore the market experts daily predictions, some of them have a flair for drama and the dramatic and would go and predict the market(unsuccessfully) every day. Instead talk to your a financial advisor ( if you have one) on the investment plan based on you financial position and goals. Many value investors have now bored the public to death by preaching the virtues of staying invested in the markets at all times, but they are bang on ; and it would be my advice to the readers as well- STAY INVESTED AND ADD ON TO GOOD STOCKS.

BTW, i was going through past performances of some stocks and was surprised to know about some of them which have given astounding resturns in the past decade but are yet to come in limelight mania of multibagger chasing.

Menon Bearings : has been a 32 bagger in the last 14 years( adjusted for splits)

Patels Airtemp : has been a 50 bagger in the last 13 years!!!!

Century Ply : has been a 20 bagger in the last 12 years.

KPR Mills : has been a 25 bagger in the last 7 years

CCL Products : 30 bagger in 12 years.

and Lastly

FLUIDOMAT has been a 100 bagger in the last 15 years.

Cheers

Gareeb Equity Analyst

Hii

10 days ago , we posted analysis of Royale Manor on this blog. The post can be accessed just below this current update.

It gives us great pleasure to note that even though the market is down by 500 points on the BSE sensex, and all the big scrips are crashing, still this smallcap gem has managed to trade at UC . Overall the stock has given a return of 32% since Dec 28.

Although the stock was supposed to appreciate over a longer time interval , however it has managed to outperform the market in this short term as well. Whilst this does not mean that the story on the stock is now over , it does serve to underline that if the analysis is right , many times the returns can be awesome in the short run.

Also I would say our insights were supported by lady luck as well, because last 2 weeks midcaps had been the flavour of the markets and this played its part in putting some spotlight on Royale manor.

All those who invested in Royale Manor, enjoy!!

GareebEquity Analyst

This one is purely for the Lynch lovers- the man who could almost always see the levels at which a stock would become attractive. This is not a multibagger, nor a hidden gem as people like to term their favourite stocks – but rather more of a cigar butt.

Stock in question is Royale Manor – BSE code 522640. Currently quoting at 12.94 rs on BSE. Company website is http://www.rmhil.com/

The stock has a market cap of 20 crores. Before we go any further lets first find out what the company is about – Royale manor is the corporate listed name for The Taj Gateway hotel Ummed, Ahmedabad. Simple. 🙂

So basically what it means that at today’s closing market price you can buy a 4 star Taj Gateway hotel, Ahmedabad at 20 crs. !! Now before it might seem that this is a steal lets do a quick evaluation of the scrip. The hotel is situated right outside Ahmedabad’s SVP international airport. Earlier this location used to be far away from most parts of the city , but as is with the case for rest of India, development in the last 10 years has led to a lot of infra and sub-urban housing developments near the location.

Stock was listed somewhere back in 1998 ( not able to find the exact year). the land was valued at 3.9 crs back then. It is still valued at 3.9 crs in the balance sheet!! Hotel is built on approximately 4-5 acres of land. Given that prime land is going at around 5-7 crs/ acre in this part of the world, i leave the calculation of the land liquidation to the reader.

Company is not loss making unlike most hotel chains and it speaks of the conservative approach of the management. Even though they are in hotel industry they have stayed away from ambitious expansion plans, and only gone for necessary renovation to keep the hotel uptodate ( though online reviews suggest the propert decor is a bit dated)

Also there is one interesting observation: back in 1998 when it seemed that the hotel would need debt, promoters issued 24,10,000 equity shares of Rs.10/- ,issued at par and allotted to promoters group companies on a preferential basis pursuant to loan conversion. So in times of need , promoters are well off enough to avoid going to the bank for strategic capital infusion. Also it is interesting to note that the FV of the share is 10 Rs and currently it is quoting at 13 Rs. So basically the fruits of the years of hardwork are yet to be reaped. As a retail investor i am still able to invest in the business at the same entry price after the business has grown and established itself over a period of years .

And this is a business with a land bank and Taj brand recognition. A hotel business takes around 10-12 years to break even but it should be noted that even in the worst of the times in 2009, hotel did not make a loss. So business wise i dont foresee any worries. Although they do need to renovate again to keep up with times. There is a debt of 9 crs in the book , but D/E ratio is a comfortable 0.35 so not much worries there.

The MD of the company Mr Ummed Champawat , takes a salary of only 9 lakhs per annum . To me this is plus point, because unlike many other companies he could have taken a hefty salary but he has decided to keep it at low level and instead decided to focus on increasing business returns. So far company has not given any dividend except once to preferntial share holders, currently over 1.6 cr shares are outstanding. Giving adividend of even 50 paise will mean all the cash in the book will be exhausted, so i think there is still sometime ( say 2-3 years) before the company starts paying dividend to shareholders. Growing trade recievable are a cause of concern , because it means some of the corporate customers are delaying payments.

Overall hotel business dynamics are improving and being so close to the international airport means room occupancy is bound to go up. Also ahmedabad airport is one of the 7 in the country to have been granted the e-visa arrival facility for foreign tourists. That has recently led to a huge surge in the foreign tourist arrivals since september onwards.

Overall this should be beneficial for the whole tourism and hospitality industry and royale manor is well placed to take advantage from it. So overall business dynamics are relatively steady and firming as of now , and strong possibility to improve going ahead.

So as someone said- heads i win, tails i dont lose much. To me the fair value of the stock is something like 32-35 Cr which means i would want this stock to rule at 21- 22 Rs levels.

Risks involved :

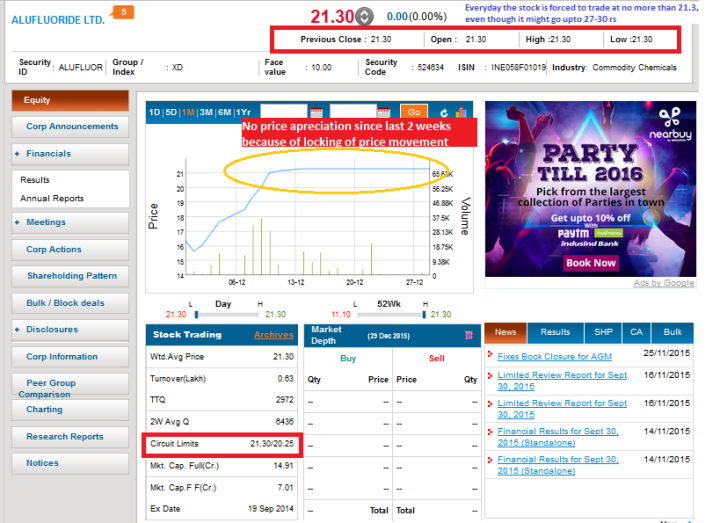

As you can see, BSE has locked the upper price movement, and since the stock is in demand it is not going down. So everyday it opens and closes at the same price – 21.30 Rs. Needless to say, this scrip is going at 100% delivery. Something like that might also happen to Royale manor and arrest its upwards movement.

Note : This rule has been implemented recently by BSE in order to dissuade people from investing in low liquidity scrips. ( Operators generally target low liquidity scrips in order to fleece unsuspecting retail customers by jacking up prices and then dumping the stock). However the real reason i see is that BSE wants to bring more volumes into their Index A, B and C scrips where the real fees is to be earned thorugh trading volumes. These are not exactly the best of times for such frontline stocks and indexes, although smallcaps are having a field day. Back in 2012-13 BSE introduced a similarly shitty rule of Periodic call auction which was later done away with just before the modi rally began .

As always it is upto the investor to decide

Cheers

Gareeb Equity Analyst

P.S: Those who want detailed charts and analyses , i m sorry.

The current period of low momentum cycles of bull and bear trends is the most boring for the average investor. Stocks are generally declining or stable with not much upward movement. An average or below expectation result is sending stocks hurling down by 5, 10 or even 15%. Some sectors like Pharma, Tech and Speciality chemicals are still resilient but overall market breadth is such that although sensex is down by 15% from its year highs , many stocks are down by 20, 30 or even 50%.Very few stocks are however now resurging on the back of re-rating/ turnarounds and/or good results.

Too many factors at play here once again to suit the mood of the markets. Lets have a look at the list:

This particular bull run has also seen one new aspect of advising- investment guru following by retail investors. Big money was invested taking cues from the various investment gurus – some of whom were hawking their wares with much fanfare – while others kept on going about their businesses with regular candor. Some of the gems picked up by these gurus are have made 52 week low this last week , while some are still blazing all guns.

However as Warren buffet said , ” It is only when the tide goes down do you find who were swimming naked’. So the markets have voted their money and many naked candidates are now looking to cover themselves.

Some learnings from the last 6 months :

High PE Vs growth : Unless it is an asset play, never pay through your nose for owning a growth stock. If the PE is too high no matter whatever sector a stock is , at the end of the day the only reason you will be buying if is if you ascribe to ‘The Greater fool theory’. In most cases when the bull market subsides and the euphoria ends you will be staring at losses – not because of business issues but because of PE moderation. Of course there are many PE traps as well which an investor needs to avoid but overpriced stocks are a certain area to avoid.

Winners can be found in all sectors , even beaten down ones : Every business goes through its ups and downs – and while no one has the crystal ball to tell when has a particular stock peaked or bottomed out, still there are many cases where the downside is limited due to the inherent value in the assets of the company. In other words , i am simply advising you to be a value investor . Good thing is that Value will exist in almost all companies at a particular price point – provided the investment thesis itself does not get expired.Some stocks which have appreciated considerabley in the last 4 -5 months

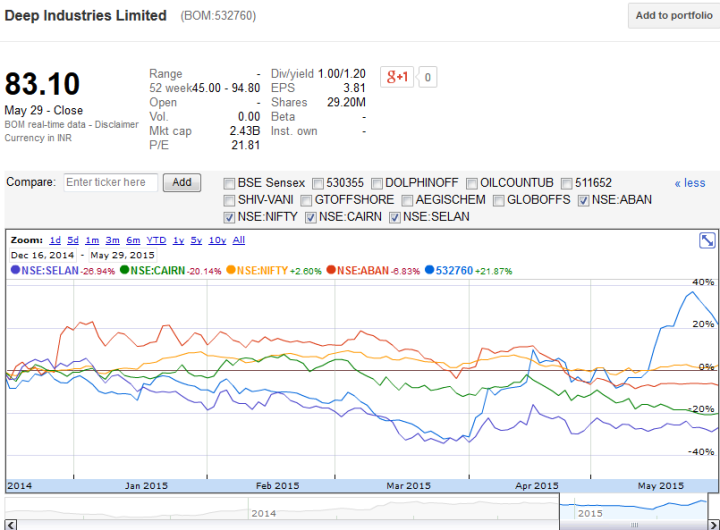

Deep Industries – in Oil and gas sector

Nelcast , Bhagwati autocast, Magna electro – Almost the whole foundry and castings sector which is reeling under pressure

Manappuram finance in gold loan business

TamilNadu Newsprint & Papers limited in Paper business

All these sectors are troubled ones with a lot of headwinds ,But good managements always are able to find avenues for generating returns

Only Listed player in its category: This is an oft invoked reason for buying a particular stock and often a wrong reason at that.

Being the only listed diamond helps, being the only listed stone does not help. So find diamonds to invest in if the price is reasonable. Some good examples of only listed players who have not done well in the last 6 months due to various reasons :

Cox and Kings, Marico Kaya, Speciality restaurants etc.

Some which have done well are Pressman Advertising, Mahindra Holidays

Is the sector going through a tectonic shift ? If yes how is the management addressing that ?

Kodak, Moserbaer , Nokia – all are dead or dying because they failed to change with the surrounding ecosystem. Today many branded products are facing challenges from the online shopping portals which are certainly eating into some portion of their revenues by providing more reasonably priced options. Businesses like Bata are already feeling the heat of that. Similarly Newspaper advertising revenues have dipped because circulation growth has tapered. So Media and entertainment firms like DB corp , Jagran prakashan etc have to gear up to slog it out on various platforms if they want to retain their growth trajectories. If the management in these industries fails to negotiate the challenging curves ahead, all the historic business performance cant help the company and its shareholders.

Niche product, Ethical management, Debt free company, Moderate PE less than 15 , high promoter holding, dividend paying , Sales and Profit CAGR at >15% , trade recievables in control and 15% plus ROE:

Almost 70% of the cases which qualify for the above description (that i have tracked over the last 6- 7 months) have given above normal returns vis-a- vis markets. Now the only catch here is what will qualify as a niche product and how to ascertain the ethics of the management. That is a tough nut to crack and requires quite some reading about the company and its annual report but over a period of time one generally gets an idea of the promoter’s integrity. Of all the parameters , good management is a basic requisite for a company to create wealth in the long run.

Cheers

Gareeb Equity Analyst

No, As much as the reader is expecting investing gyan to follow, that is not the objective of this post.

gyan to follow, that is not the objective of this post.

There is a ton of material out there on the web to help anyone decide which is the stock to buy with the biggest potential upside. The objective of this post is to make the reader understand that more than the analytics, there is something else which is more important than the research and all the efforts that a person puts into analyzing a stock. For the lack of a better word , i will simply call it – RATIONALITY. When Charlie Munger was asked to describe himself in one single word, he finally zeroed down on that he was ‘rational‘. Such a simple word, such a vast array of connotations………………………….

with the biggest potential upside. The objective of this post is to make the reader understand that more than the analytics, there is something else which is more important than the research and all the efforts that a person puts into analyzing a stock. For the lack of a better word , i will simply call it – RATIONALITY. When Charlie Munger was asked to describe himself in one single word, he finally zeroed down on that he was ‘rational‘. Such a simple word, such a vast array of connotations………………………….

Buying High PE stocks:

As much as investing sense dictates that one should only get into stocks when valuations are reasonable, the euphoria caught on to even some of the savviest investors- many of whom have had made their names in this current bull run since Jan 2014 – and they advocated buying stocks at skyrocketing valuations claiming that if the company had free cash flows then earnings will sooner or later catch up. Basant Maheshwari declared hawkins as the stock pick of 2015 , and also very strongly advocated buying into some other names like Page industries , Gruh finance

at skyrocketing valuations claiming that if the company had free cash flows then earnings will sooner or later catch up. Basant Maheshwari declared hawkins as the stock pick of 2015 , and also very strongly advocated buying into some other names like Page industries , Gruh finance , irrespective of valuations While they may be seemingly right with their rich experience, the markets dont seem to be in agreement.The darlings of the markets- Gruh finance and Hawkins are down by 25% to 50% from their recent highs and 10% down from their December price. Only Page industries has managed to give 25% returns from its December price.

, irrespective of valuations While they may be seemingly right with their rich experience, the markets dont seem to be in agreement.The darlings of the markets- Gruh finance and Hawkins are down by 25% to 50% from their recent highs and 10% down from their December price. Only Page industries has managed to give 25% returns from its December price.

With all due respect to Mr Basant , he should have known the risk associated with giving too much premium for quality. As Warren buffet said – ‘ let the price of purchase be so attractive that even a mediocre sales gives good results’- basically what he meant was that paying a high price for a wonderful company is not so advisable- unless of course it has got the leasing rights to the White House . 😉

With all due respect to Mr Basant , he should have known the risk associated with giving too much premium for quality. As Warren buffet said – ‘ let the price of purchase be so attractive that even a mediocre sales gives good results’- basically what he meant was that paying a high price for a wonderful company is not so advisable- unless of course it has got the leasing rights to the White House . 😉

Buying equities irrespective of Market conditions:

While the 1st point advocates that reasonable price should be paid for acquiring a good business, as a corollary the second point reinforces it by saying that even if broader market is trading at high valuations , one can still buy a particular stock if the valuations are correct. One good example is HCL technologies. The stock fell kept on delivering good results as compared to peers and valuation wise never crossed a PE above 20. So it was a reasonable buy at dips. Lets have a look at performance of HCL scrip Vs Market in the last 6 months  The scrip has appreciated by 20% in last 6 months, and managed to beat index returns by 22%. Even if you entered this scrip in the dip of April 2015 , it would have given you 15% returns ( stock was quoting at 860 on 28th April).As far as i know, none of the Value investors were recommending HCL Tech in the last 1 year. I m sure that in the long run many of their stock picks

The scrip has appreciated by 20% in last 6 months, and managed to beat index returns by 22%. Even if you entered this scrip in the dip of April 2015 , it would have given you 15% returns ( stock was quoting at 860 on 28th April).As far as i know, none of the Value investors were recommending HCL Tech in the last 1 year. I m sure that in the long run many of their stock picks would be multibaggers , but for a retail investor with limited money to spare the portfolio should be a mix of stalwarts as well as hidden gems and this is where buying stalwarts at decent valuations makes sense.

would be multibaggers , but for a retail investor with limited money to spare the portfolio should be a mix of stalwarts as well as hidden gems and this is where buying stalwarts at decent valuations makes sense.

Finding hidden gems in beaten sectors:

As peter lynch said – ‘ Take the industry which is surrounded with the most gloom and doom and if the fundamentals are positive , you will find some big winners’. Luckily such a situation arose around 5 months ago, when global crude oil prices nosedived and then some more. This led to a crash in the stock price of oil exploration, production and services companies. The favorite of the value pickers – Selan exploration got butchered along with Cairns , Oil india limited, Aban offshore etc but lets have a look what has happened to an oil production services company – Deep industries. Yes, you got it right, Deep industries has not only managed to beat its peers , but it has also managed to beat Nifty returns in the last 6 months despite oil exploration and services companies getting beaten out of shape. While Cairns, Aban, and Selan are down by 25-40% down from their december prices and at 3 year lows, Deep Industries has given 22% returns in that period and touched a 3 year high a few days ago. Although i had not given a public buy call on this stock but i had purchased it for myself in March at 49 Rs, because to me the stock was just too attractive at that price and i then shared my acquisition with many of my investor friends. Luckily stock has given an appreciation in such a short period which i had not anticipated , but such are equities. However , i had taken a long position on Aban offshore on the basis of similar reasoning but that story has not yet panned out. But a very important lesson learnt that Uncle lynch was correct as a rock.

Yes, you got it right, Deep industries has not only managed to beat its peers , but it has also managed to beat Nifty returns in the last 6 months despite oil exploration and services companies getting beaten out of shape. While Cairns, Aban, and Selan are down by 25-40% down from their december prices and at 3 year lows, Deep Industries has given 22% returns in that period and touched a 3 year high a few days ago. Although i had not given a public buy call on this stock but i had purchased it for myself in March at 49 Rs, because to me the stock was just too attractive at that price and i then shared my acquisition with many of my investor friends. Luckily stock has given an appreciation in such a short period which i had not anticipated , but such are equities. However , i had taken a long position on Aban offshore on the basis of similar reasoning but that story has not yet panned out. But a very important lesson learnt that Uncle lynch was correct as a rock.

A similar industry is the real estate sector – if you have any potential winners, i am all ears. 🙂

Keep emotions out of investing and of course patience is the golden word :

As Ben graham equated markets to a moody seller who changes the price he is willing to accept in exchange for selling a small ownership of the business, it was quite entertaining to see that happen to my portfolio . Some of my scrips swung up by 15% and down by 20% just for no reason, based on market moods and weak hands selling and strong hands buying or vice-versa. In general this leads to panic amongst the investors. They think that the party is over and they should quickly get out to convert their paper profits to cash. However many are surprised and puzzled when they see those stocks coming back to their earlier levels and even surpassing them. There is no cardinal rule of when to sell stocks but one situation which certainly does not count as a correct reason is – that the broader markets are correcting/ consolidating.

If everything is ok with the business and the stock, then market corrections should be seen as an opportunity to buy more instead of cashing out. Good stories take some time to develop and a time frame of 3 years should be given to see if your thesis of investment in a particular stock pans out or not – provided all other things remain stable.

Remember , to achieve 10 times returns in 10 years , all it takes is an annualised return of 26%.

To be continued……

Cheers Gareeb Equity Analyst

The month gone by was a rollercoaster ride on the exchanges. In my last post i mentioned that market valuations are saturated and a correction seems probable. Keeping in line with those expectations the NIFTY gradually wound down from 9000 levels to 8350 levels almost down by 8%, before bouncing back in the last week to settle today at 8660 levels.

If you open the business channels a week ago almost everybody was trying to predict how much will the market fall before settling down and how much will be the impact of Saudi attacks in Yemen. Veteran stocks like ITC were thrashed to 315 Rs versus a 52 week high of 400 Rs encountered just a month ago.Even quality midcaps and small caps corrected by 15-20%. Suddenly all analysts started giving an opinion that market was overvalued and long term story is intact but present valuations are steep and wait for the NIFTY to settle to 7800 from where one can initiate fresh positions.

With all due respect to these learned analysts and traders , i do not claim to be more knowledgeable than them, but my main bone of contention is that all these analysts make just the right kind of noises required to appear on prime time business hour.It may suit them and their trading strategies and the needs of their respective organization but this unnecessary noise is the biggest enemy of the discipline and courage required by a retail investor to invest in good businesses.

Lets have a look at how the NIFTY, BSE Midcap and BSE Smallcap have fared in the last 3 months. The graph below shows the relative performance of all 3 indices in a period of Jan 1st- April 6th.

As can be clearly seen , the smallcap index got hammered the most and returns went even negative for the smallcaps.If you invested equal amount of money in all the 3 indices in January, in the recent correction the largecaps had fallen the least and you would have been in some minor profits, for midcaps you would be just about breaking even and for smallcaps you would have lost 5% of your wealth. In case you were unlucky enough to have some high beta small cap this figure of loss would have been in the range of 15-20%. Suddenly you would have started to regret why did you abandon the safety of large caps and why did you ever listen to the person who had advised you to invest in a good scrip that happened to be a small cap. That feeling gets further intensified once you try to crosscheck your worst fear with the opinion of the market pundits. Almost invariably the market pundits go into a gloom and doom mode whenever a correction happens. This confuses the retail investor even more and sometimes he ends up selling the stock to limit his losses or at the best sit as a mute spectator leaving everything in the hands of lady luck.

This approach is what separates the savvy investor from the novice.

Since it is almost impossible to divine the market movements , therefore one cannot time the markets ( even if they claim to) , so the best possible option is to keep buying on dips. In the example of the index, it has a fluctuation of almost 7% in a period of 2-3 weeks. Assuming you entered a stock when it was quoting at price level A, then last week you saw it go down all the way to level B , what would you have done ? Well the correct thing to do is add on dips. Assuming that you added more of stock at levels B , then your average holding price works out to be C. When the market rebounds ( which you are not sure of how soon will that happen) , then you turn profitable. Simple. Problem is that people dont know whether it is ok to buy at B or to wait for even lower prices . Well,that totally depends on the investor outlook. If i am very bullish on a particular stock , then even a 5% fall makes it seems even more attractive, while if one is not so sure of a stock’s valuations, he can add more on 10% dips.

Lets take a live example:

CARE rating was advised on this blog at 1600 levels. It went down to 1450 in the recent correction. If you would have purchased the stock at 1450 in the recent correction your average price would have come down to 1530 Rs. As of today CARE has bounced back to 1620 Rs and hence you could have been sitting in 6% Profit. If you want to hold a stock for long term, these addition on dips gives you the great advantage of lower holding prices than the one you initially entered at. Have a look at CARE Rating stock price below.

As for broader markets, i believe we have already seen the top and it can be said with a 90% certainty that we will not exceed 9000 on the Nifty by December 2015. That is another 8 months to go.

Cheers

Gareeb Equity Analyst